Which do you prefer?

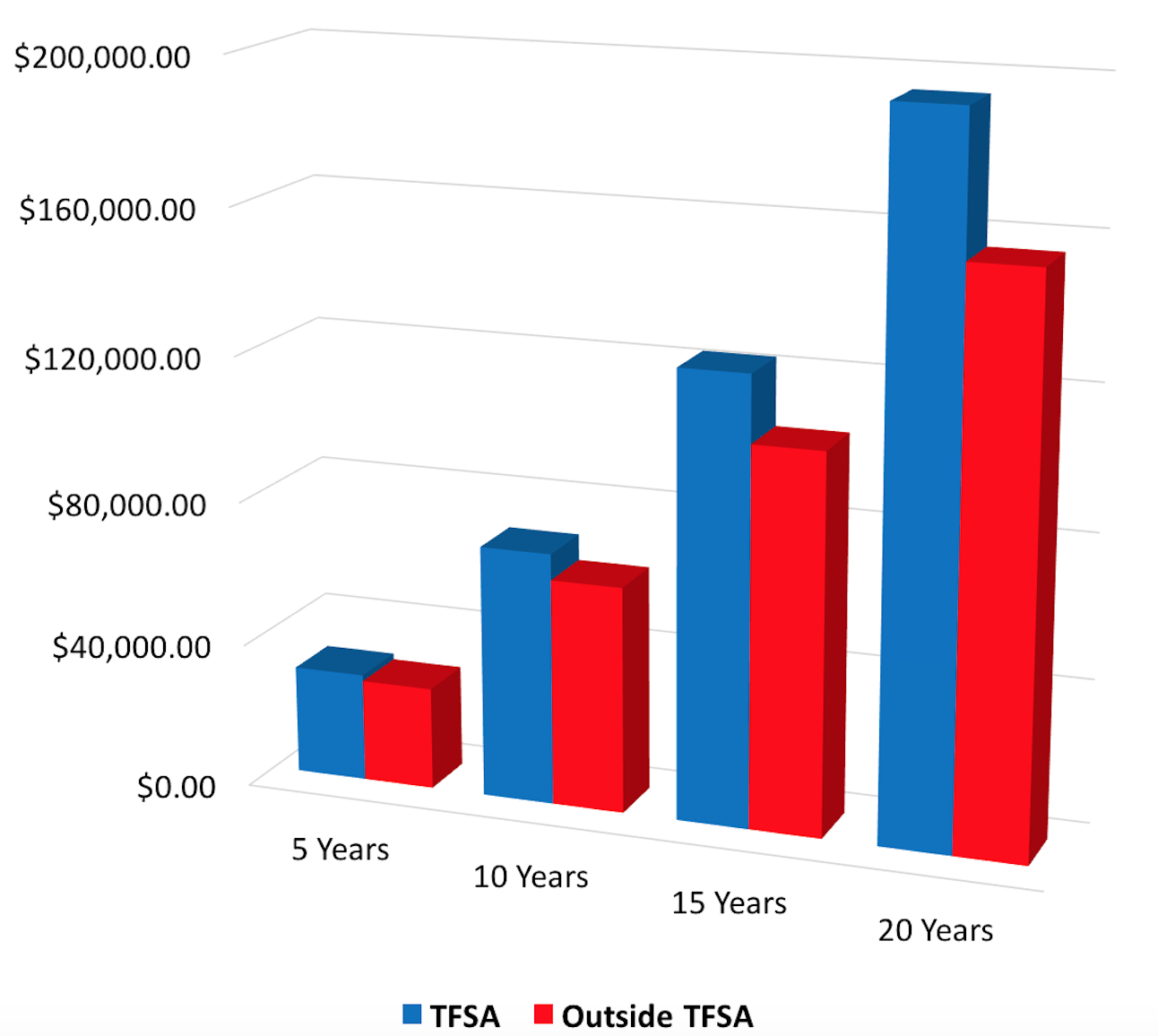

If you’re not already contributing to your TFSA – it’s a good time to start. The Tax-free nature of the account amplifies the effect of compounding growth – meaning your hard earned money grows faster inside a TFSA than in a taxable investment account.

Assumptions used in illustration: 32% Tax Rate, Rate of Return of 6%, Contribution of $5000 at the beginning of each period.

Introduction

A TFSA is a type of investment account that provides investors with greater flexibility and tax benefits. Contributions to a TFSA, unlike an RRSP, are not tax-deductible, however returns (interest, dividends, or capital gains) within a TFSA are not taxed, even when withdrawn.

Simply put, tax-free growth and withdrawals make a TFSA an attractive option for those saving up for a car, home, or vacation.

Tax Free Withdrawals

You can take money out when you want, for any reason, without paying any tax.

Recontributing is Permitted

If you take money out, you can re-contribute in the following year, in addition to the annual maximum

Flexibility

You can hold a wide range of investments in a TFSA. Put your money to work by investing in a high interest bank account, GICs, and many other products.

How can Crossgrove & Company help?

Any Canadian resident age 18 or older with a Social insurance number is eligible to open a Tax Free Savings Account. Maximizing TFSA contributions is an ideal first step for a young investor. As seen graphically, consistently contributing over a 20-year time period can leave you much better off financially. Talk to a Crossgrove & Company advisor to open an account, and start putting your money to work.

How is a TFSA different from a non-registered investment account?

In a non-registered investment account, earnings are taxed as interest, dividends or capital gains in the year that they are earned. Taken together, taxation simply means less after-tax dollars within the account year-over-year, and, more importantly, it detracts from the effect of compounding, meaning the gap will only get bigger over time.

How much can I contribute to my TFSA?

Currently, the annual contribution limit for a TFSA is $5500. However, unused contribution room accumulates and never expires. Click on the “Contribution Room Calculator” above to get an idea of how much you can contribute.